2020 estimated tax payment calculator

In addition to the Delaware Franchise Tax estimated payment above corporations will also be charged a 50 annual report fee. For your CA AGI go to.

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

2021 2022 Paycheck and W-4 Check Calculator.

. You MUST make estimated tax payments by the required due dates. See When To Pay Estimated Tax. However if you were working for the same employer in 2020 were paid wages in 2020 and failed to furnish a Form W-4 your employer should continue to treat you as single and claiming zero allowances on a 2019 Form W-4.

If you havent received a bill you can still make payments using one of our other payment options. The exact franchise tax amount due will depend on the entitys specific internal details. Forbes Advisors Mortgage Calculator uses home price down payment and other.

Comparsion to federal estimated tax Oregons estimated tax system is similar to the federal sys-tem except that you. Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments. Usually thats enough to take care of your income tax obligations.

The majority of 2020 Tax Forms are listed below or you can search for tax forms. Use the 2020 Tax Calculator to estimate your 2020 Return. What you may receive.

Recommends that taxpayers consult with a. Use Oregons income tax laws and tax rates. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

As such it is possible to underestimate resulting in an underpayment and penalty. Generally if you filed electronically and received your 2020 tax refund by direct deposit then you should get your payment the same way. This is only an estimation of an entitys Delaware Franchise Tax amount due.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. The estimated tax payment is based on an estimation of your income for the current year. 2021-2022 Tax Brackets Tax Calculator.

The provided calculations do not constitute financial tax or legal advice. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. Refer to the tables below to determine your payment amount.

Youre eligible to set up a payment plan with us if you owe less than 25000 in combined tax penalties and interest and do not have any of the following collection actions. Estimated federal taxes 15009. Dont include Social Security tax FICA self-employment tax or household employment tax in your calculations.

Since that date 2020 Returns can only be mailed in on paper forms. Review the Electronic Payment Guide for details regarding general requirements and the set up with financial institutions which may include fees. Include your tax account number FEIN and specific tax period of the return or voucher on the check.

If you have any such income coming in then you should pay the estimated tax. This calculator is for the 2022 tax year due April 17 2023. Use this free tax return calculator to estimate how much youll owe in federal taxes.

Now for those of you who just wanted to know how to calculate your estimated self-employment tax. Otherwise you will receive your payment on a debit card. We also offer ones covering 2016 2017 2018.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. To avoid this penalty use your previous years taxes as a guide. Use these free online fillable forms to complete your 2020 Return before you sign print and mail your return to the 2020 IRS address.

Unlike the federal system estates and trusts are not. Set Up A Payment Plan You can only set up a payment plan if youve received a bill from us. Line 17 on your 2020 Form 540.

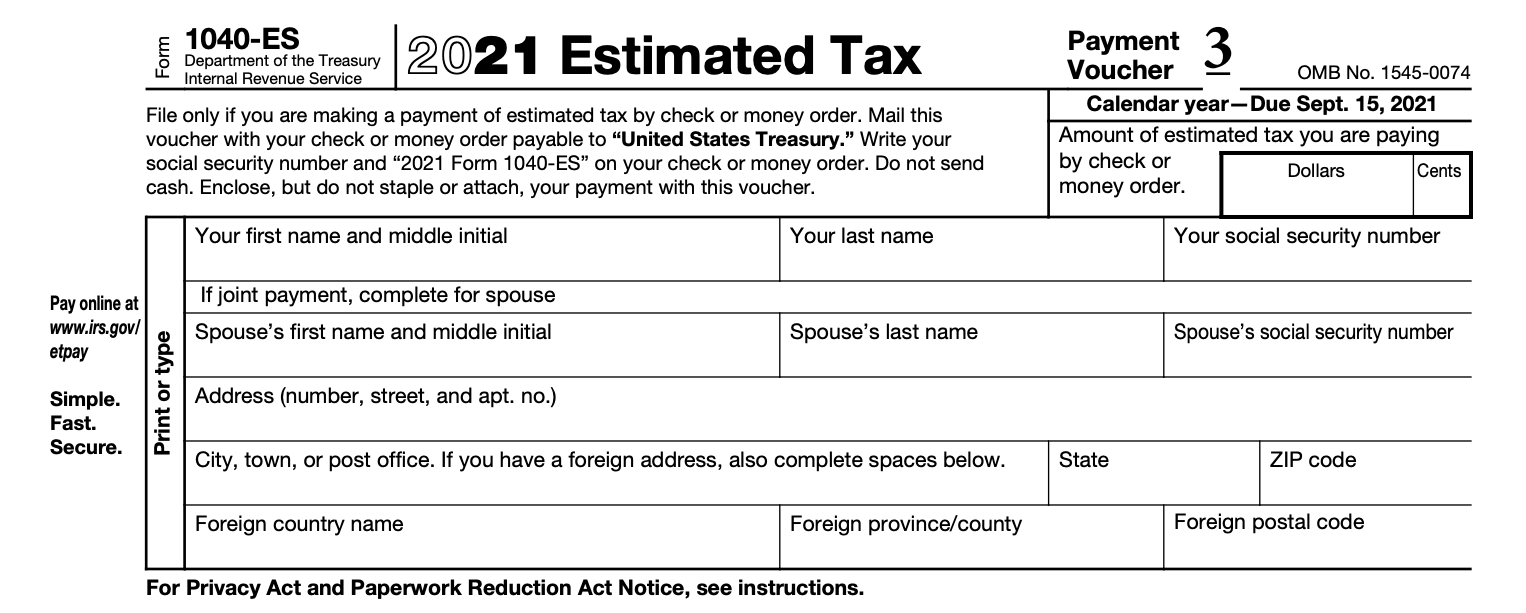

Check or Money Order. If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. Request an extension of up to 120 days to pay in full by applying with the online payment agreement or by calling 800-829-1040.

Pay by check or money order payable to the Virginia Department of Taxation. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021 Estimated Taxes. You can sign up for a payment plan on the IRS website.

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Aca Penalty Calculator Health Insurance Coverage Full Time Equivalent Employment

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Strategies For Minimizing Estimated Tax Payments

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Estimated Taxes 1040 Es Explained Calculator Available Youtube

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Pin On Usa Tax Code Blog

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Quarterly Tax Calculator Calculate Estimated Taxes